Margin call options

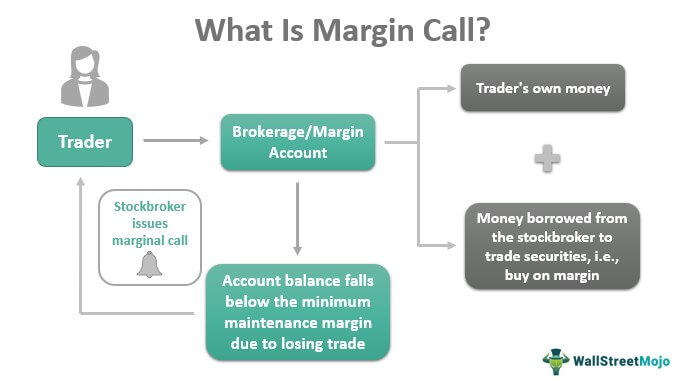

Margin in Options Trading. A margin call is when CommSec requires a client who has written options to provide additional cash or stock as collateral for their open positions.

Selling Writing A Call Option Varsity By Zerodha

A margin call is a broker s demand on an investor using margin to deposit additional money or securities so that the margin account is brought up to the.

. The option margin is the cash or securities an investor must deposit in his account as collateral before writing options. Lets get started today. Your broker has the right.

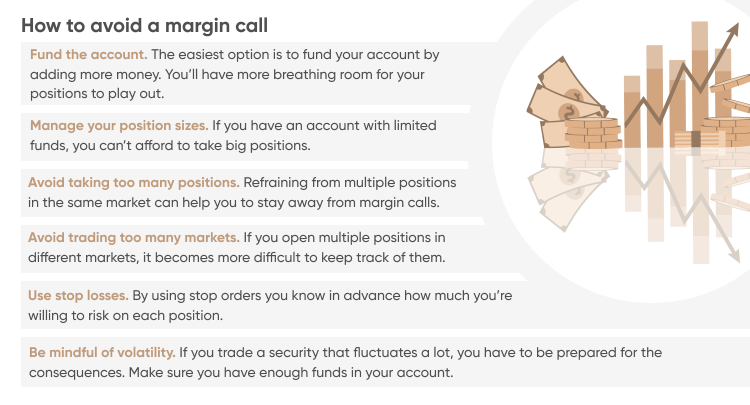

The margin call requires you to add new funds to your margin account. Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. When selling writing options one crucial consideration is the margin requirementCorrect planning in this area will help you to avoid the stress of a dreaded margin.

Ad Put More Purchasing Power Behind Your Trading With Margin Privileges. In options trading margin also refers to the cash or securities required to be deposited by an option writer with his brokerage firm as collateral for the writers obligation to buy or sell the. In options trading margin is very similar to what it means in futures trading because its also an amount of money that you must put into your account with your.

Another option to meet the margin call is to. Rates subject to change. The loan value is equal to 100.

In the hopes of sparing others the same experience I faced here are five ugly lessons from that nasty margin call. You might not face a margin call until your account balance declined by 3333 to 133333. Regulation T states an initial margin must be at least 50 although many brokerage firms set their requirements higher at 70.

At that point the debt would be 75 of the total account balance. Your interest rate depends on your debit balance and Schwabs base rate. Calls for September 16 2022.

Base Rate 0075. In this case youd receive a margin call to deposit 300 by the due date. This schedule contains a description of Exchange margin requirements for various positions in put options call options combination put-call positions and underlying positions offset by.

Ad Were all about helping you get more from your money. 1 This means an investor. US Options Margin Requirements.

Margin rates as low as 283. As a resident of the US trading options in US you are subjected to Rules-based margin and Portfolio Margin. Fed Margin Calls.

Interest accrues daily and is posted. If You Fail to Meet a Margin Call. Ad Open an IBKR account with no added spreads markups account minimum or inactivity fee.

63 rows View the basic AMC option chain and compare options of AMC Entertainment Holdings Inc. Soybean call option premiums on June 1 are shown in Table 3. Futures prices have risen from 1250 to 1425 during the three month period.

A sells 1 lot lot size is 600 shares of call option of Infosys. 2 Depositing Securities to Meet the Margin Call. See how this trading course helps small investors earns Extra Income.

The premium received is Rs 10 for the strike price of 970 and we assume a margin. The complete margin requirement. Margin requirements vary by.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Soybean Call Options - June 1. Margin for options example.

To determine how many shares would be necessary to meet a 2000 margin call Ellen divides 2000 by the loan value of the stock she plans to deposit. What is an Options Margin Call. If you do not meet the margin call your brokerage firm can close out.

/Margincall_final-a2874e135727477d953acce6a3a62643.png)

Bjbnfe3tuihvum

Margin Call Price Formula And Calculator Excel Template

/Margincall_final-a2874e135727477d953acce6a3a62643.png)

Bjbnfe3tuihvum

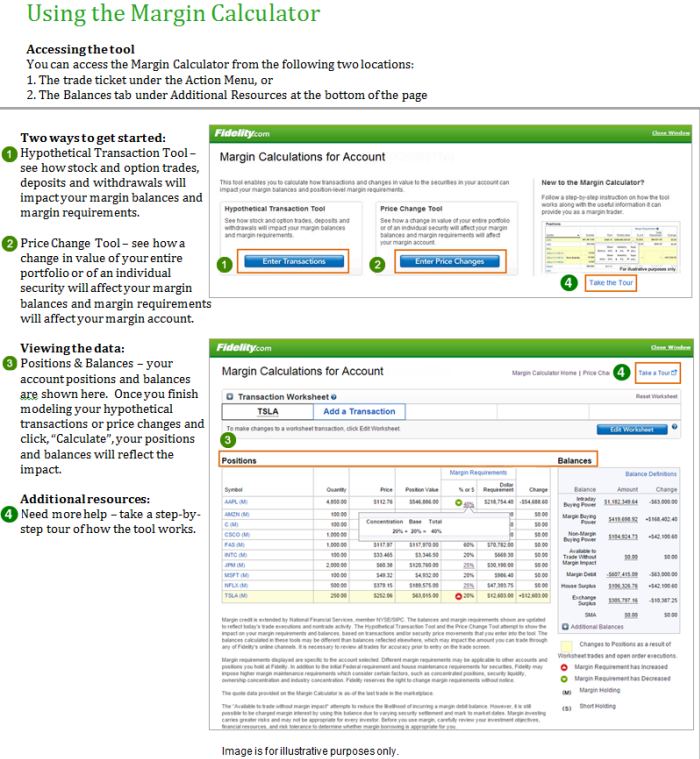

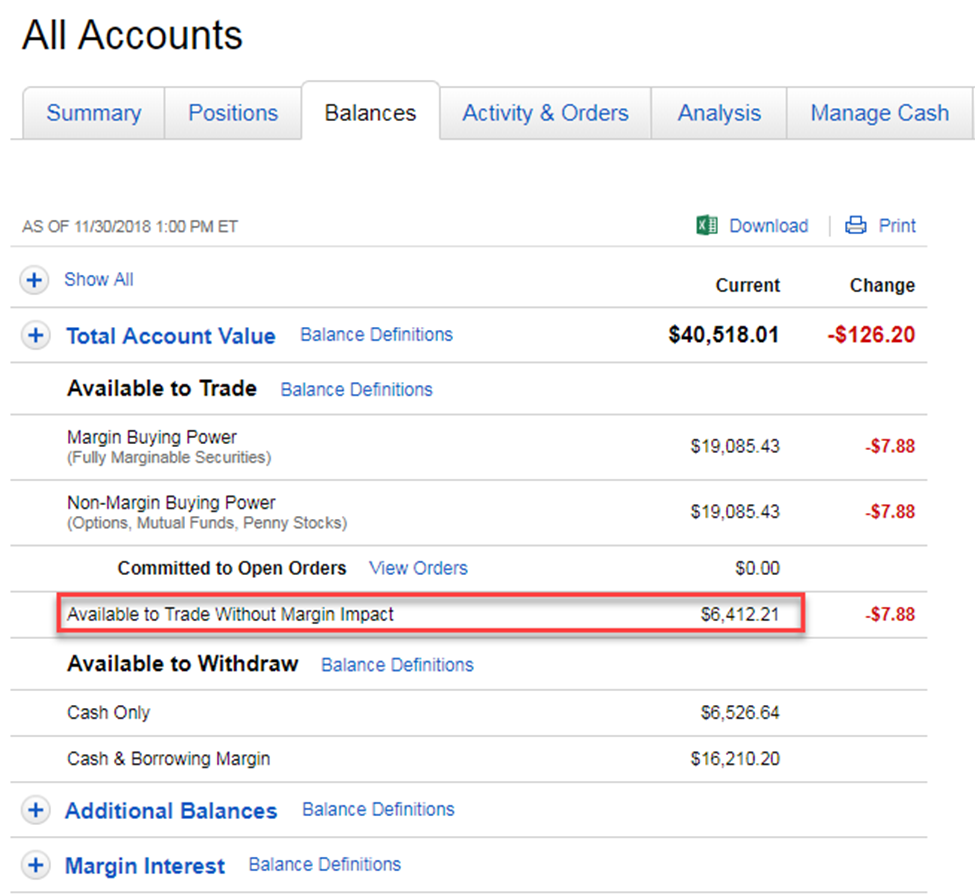

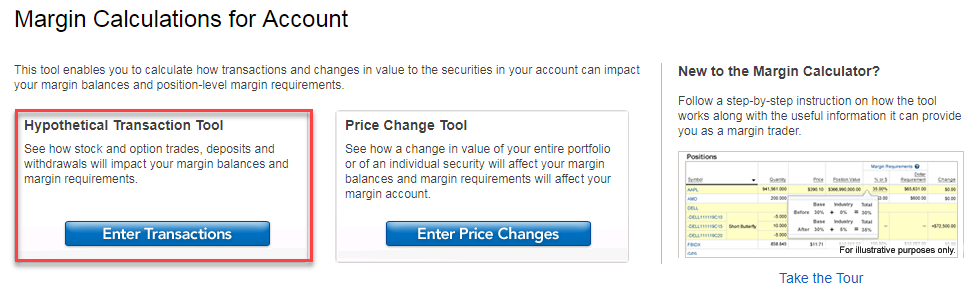

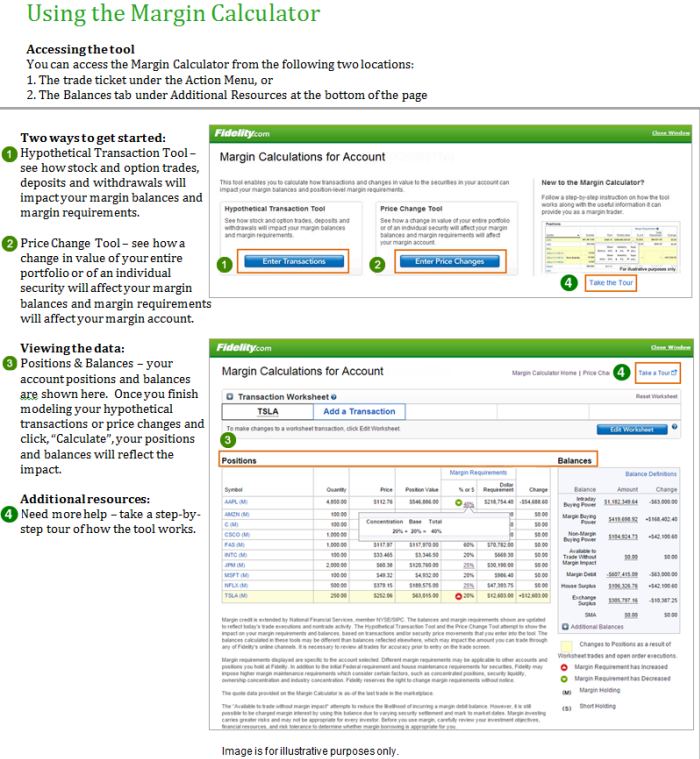

Trading Faqs Margin Fidelity

Margin Call Meaning Explanation Examples Calculation

How To Handle Margin Calls Youtube

Trading Faqs Margin Fidelity

Trading Faqs Margin Fidelity

What Is Margin Call In Forex And How To Avoid One

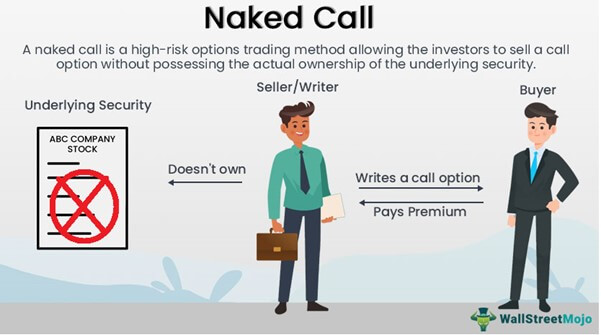

Naked Call Option Definition Examples Calculations

What Is A Margin Call Margin Call Formula Example

What Is Margin Trading And How Does It Work Trading On Margin Explained Capital Com

Avoiding And Managing Margin Calls Fidelity

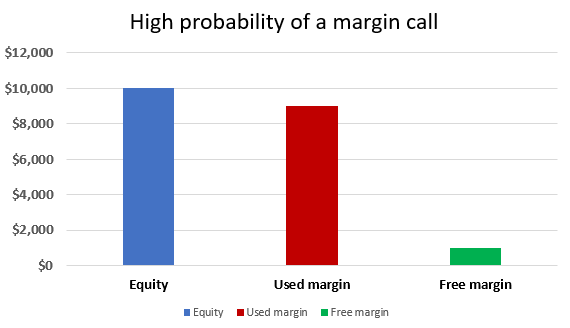

What Is A Margin Call Babypips Com

What Is A Margin Call Babypips Com

What Is A Margin Call Babypips Com

Margin Call Price Formula And Calculator Excel Template